Loans

The MB loan program began as a way to help MB churches obtain financing. Formerly known as MB Stewardship Ministries but now operating as CCMBC Investments, we continue to administer CCMBC’s mortgage lending program. We come alongside our pastors and ministry organizations to help grow God’s kingdom by offering financing solutions that take into consideration more than just numbers on a page.

The current interest rate is 5.75% for churches and 4.75% for pastors.

Loans to Mennonite Brethren churches and organizations

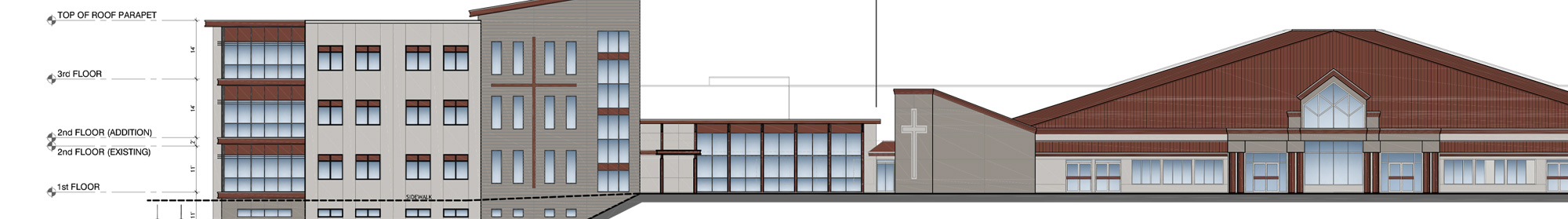

It is our pleasure to support our churches and other MB organizations such as camps and schools by providing mortgage loans to assist in purchasing, building, expanding or maintaining their meeting places or property. The Canadian Conference of MB Churches (operating as CCMBC Investments Ltd.) must be the first mortgagee. In addition, we have the following guidelines:

- The interest rate is variable and subject to change every 6 months on January 1 and July 1 each year.

- The maximum amortization is 25 years.

- Additional payments are welcomed at any time without penalty to pay down the principal more quickly and thereby shorten the length of the loan.

- CCMBC is prepared to finance up to 70% of the purchase or construction cost.

- We do not charge fees, but you are required to cover the legal expense of registering the mortgage.

We are excited to partner with our churches in this way. We do our best to ensure our mortgage rates and terms are competitive, and in many cases better than what traditional lenders offer.

To apply for a church loan, please contact Elenore Doerksen for a list of required documents and next steps.

Loans to Mennonite Brethren pastors

We offer mortgage loans to pastors in our churches for purposes of helping them to acquire housing. The home must be their primary residence and the Canadian Conference of MB Churches (operating as CCMBC Investments Ltd.) must be the first mortgagee. In addition, we have the following guidelines:

- The pastor must have completed or at least begun the MB pastors credentialing process.

- We require a 20% down payment for the purchase of a house. Total debt payments must not exceed 42% of gross income.

- Once the individual leaves the employment of CCMBC, he/she would be expected to move the mortgage to another financial institution.

- We do not charge any fees, but any legal costs involved in setting up the mortgage loan are the responsibility of the individual(s) requesting the loan.

- The interest rate is variable and subject to change every 6 months on January 1 and July 1 each year.

- The maximum amortization is 25 years.

- Additional payments may be made on the loan at any time without penalty.

We recommend that individuals also contact other financial institutions as they may be able to secure better rates and mortgage terms elsewhere.

To apply for a pastor loan, please contact Elenore Doerksen for a loan application and next steps.